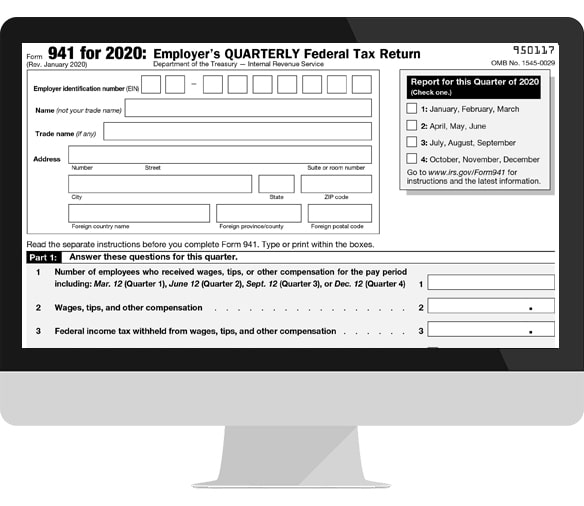

Express941: File Form 941 Online for 2020

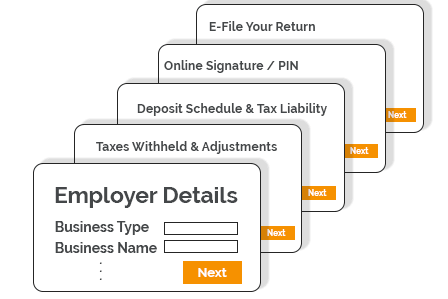

Complete E-file 941 within few steps & get instant acknowledgement from IRS

Pay Only When You Transmit to IRS

Want to know more about Form 941?

Hope the following links will provide you the information required for you to know more about Form 941.

Why Express941?

Pay Only When You Transmit to IRS

Easy, Affordable Pricing

IRS authorized Express941 provides seamless e-filing solution to E-file 941 for 2020 at the most competitive price, starting at just $4.95 per form! You can even try it for free and pay only when are ready to transmit your return to IRS.

$4.95/form

Customer Support Options

Best of all, our dedicated support team is more than happy to assist you every step of the way! Please don't hesitate to contact us via phone, email, or live chat with any questions you may have.