File 2020 Form 941 Electronically within Few minutes!

What is Employer's Quarterly Federal Form 941?

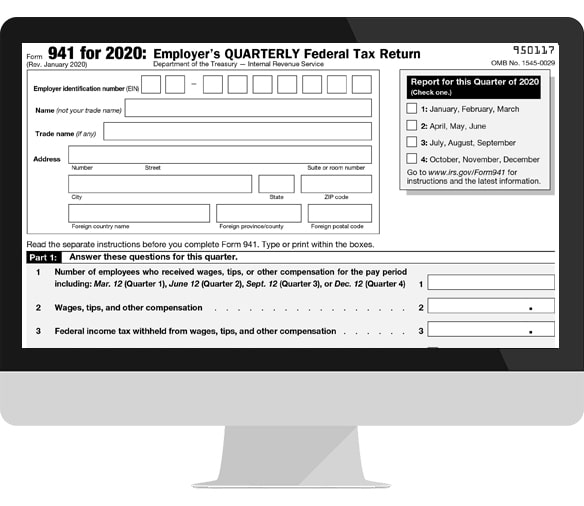

IRS Form 941, Employer's Quarterly Federal Tax Return, is an IRS information return employers use to report income taxes, social security tax, or Medicare tax withheld from an employee's paycheck. Federal tax Form 941 is also used to pay the employer's portion of social security or Medicare tax. IRS tax Form 941 should not be used to report backup withholding or income tax withholding on non-payroll payments and should not be used to report on seasonal, household, or farm employees.

IRS Revised Form 941, Employer’s Quarterly Federal Tax Return for 2020, and updated instructions to reflect the effects of COVID-19. We are ready to accept Form 941 for 2020 with COVID changes. Learn more about Form 941 for 2020.

Why Should File Form 941 with the IRS?

IRS requires employers to file Form 941 online or on paper to report certain financial information about the taxes withheld. It is important to report this information to the IRS in a timely fashion and with the complete payment to avoid any penalties the IRS may issue as a result of a late or missing filing or payment.

Quarterly 941 Deadlines for Tax Year 2020

You must file Form 941 electronically or by paper before these deadlines.

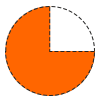

941 First Quarter

(January, February, March)

Due Date : April 30th, 2020

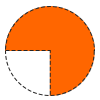

941 Second Quarter

(April, May, June)

Due Date : July 31st, 2020

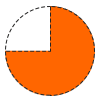

941 Third Quarter

(July, August, September)

Due Date : November 02nd, 2020

941 Fourth Quarter

(October, November, December)

Due Date : February 1st, 2021

If any of the due dates for Form 941 falls on a Saturday, Sunday, or federal holiday, the deadline is automatically extended to the next business day and you must file Form 941 online or on paper by then.

Click here to learn more about Form 941 Due Date.

What are the Information Required to File Form 941?

The following information is needed to file Form 941 online or on paper with the IRS. You will need to provide all of the information below in order for the Form 941 you file to be accepted as complete by the IRS.

Information required:

- Employer information (EIN, Name, Trade Name, Address)

- The quarter you're reporting

- Number of employees

- Wages, tips, and other compensation for the quarter

- Federal income tax withheld

- Taxable finances (SS wages/tips, Medicare wages/tips)

- Adjustments, balance due, and overpayment information

- Deposit schedule

- Tax liability

- Whether your business closed or you are a seasonal employer

- Third-party designee information (if applicable)

- Employer signature

You must also provide your tax payment along with the payment voucher when you file Form 941 online or on paper.

Click here to learn more about Form 941 Instructions.

Form 941 Explained by each Part

It's important to know how to complete your Quarterly Federal Tax Return before you e-file form 941 or on paper. in order to complete form 941, first enter your ein (employer identification number) in the available boxes. then, provide the rest of your identifying information, including your name, trade name (if any), and address. you'll also check the box for which quarter your reporting (first, second, third, or fourth) in this section.

| In Part 1 | You'll answer certain financial questions about the quarter for which you're filing Form 941. First, provide the number of employees who received wages, tips, or other compensation for the quarter, as well as the total of those wages, tips, and other compensation. Next, enter the federal income tax withheld from those wages, tips, and other compensation, or check the box to indicate that you had no wages, tips, or other compensation subject to social security or Medicare tax. If you did need to report taxes withheld, you'll take the next few boxes to provide more specifics on those taxes. You'll then determine your quarter's total taxes after adjustments made for fractions of cents, sick pay, and for tips and group-term life insurance. Next, you'll total up your deposits for the quarter and indicate your balance due. If there was an overpayment, you'll also indicate so here. |

| In Part 2 | You'll report about your deposit schedule and tax liability for the quarter for which you're reporting. In this section, you'll check one of the three boxes that applies to your payment and deposit situation before continuing on to Part 3. |

| In Part 3 | You'll answer questions about your business. Namely, you'll use this section to indicate if your business closed or stopped paying wages during the quarter you're reporting. You'll also use this section to indicate whether you're a seasonal employer who may not have to file every quarter. |

| In Part 4 | It is for your third-party designee's information if you have one. If you want to allow an employee, paid tax preparer, or other person to discuss your Form 941 with the IRS, you can include their information here. Then, next, in Part 5, you'll sign and date the form and provide your best daytime phone number. |

If you're making a payment when you file Form 941 online or on paper, you'll also need to include the 941-V, Payment Voucher. On this voucher, just enter your EIN, the amount of your payment, the tax period, and your address. Submit it with your payment and you're all done!

Visit, https://www.taxbandits.com/form-941/form-941-instructions/ for more information on Form 941 Instruction.

How to File Form 941 electronically within few minutes?

Its easy to File Form 941 Electronically with Express941 and Filing includes the other supporting forms like Schedule B (Form 941), Form 8974, and Form 8453-EMP. Just follow the simple steps to prepare your form & e-file it with the IRS.

- Create a FREE account with Express941

- Choose “Form 941” from 94x Quarterly Forms

- Enter Employer Details

- Select Tax Year & Quarter

- Follow our interview-style process to prepare your Form 941

- Enter online signature PIN, or complete Form 8453-EMP to Sign Form 941

- Review Summary, Pay E-file Fee, and Transmit your 941 directly to the IRS

What are the COVID19 changes in IRS Updated Form 941?

IRS released a new Form 941, Employer’s Quarterly Federal Tax Return for 2020, and updated instructions to reflect the effects of COVID-19.

For the Third & Fourth Quarter, 2020

Form 941 is going to be revised a bit to accommodate the aspects released in the presidential memorandum. This memorandum says that employers will now be allowed to defer the employees’ share of Social Security Tax. The changes affect lines 1, 13b, 24, and 25 of Form 941. E-file Form 941 for the third and fourth quarters here.

Click here to know more about 2020 Form 941 third and fourth quarter changes.

https://www.taxbandits.com/form-941/irs-revised-form-941-for-3rd-and-4th-quarters/

For Second Quarter, 2020

The updated new form 941 addresses the economic impacts of COVID-19 by allowing qualifying employers to defer deposits on their payroll taxes, apply for Payment Protection Program (PPP) loans, obtain employment tax credits, and claim payments towards advance credits. Employers will be required to use the new 2020 Form 941 when they submit their second-quarter filing to the IRS.

Click here to know more about 2020 Form 941 COIVD changes.

Extension for Form 941

Unlike other IRS information returns, Form 941 does not have an associating extension form to file. You can, however get an extension of time to file Form 941 online or on paper under certain circumstances. If you made payroll tax deposits for the quarter entirely and on time, you receive an automatic 10-day extension of your deadline to file Form 941 for the quarter.

If you meet the criteria for an extension, the deadlines are as follows:

- First Quarter (ending March 30) deadline extends from April 30 to May 10

- Second Quarter (ending June 30) deadline extends from July 31 to August 10

- Third Quarter (ending September 30) deadline extends from October 31 to November 10

- Fourth Quarter (ending December 31) deadline extends from January 31 to February 10

Form 941 Penalties

Penalties can be incurred for Form 941 if you fail to file form 941 on time or fail to include the payment that you're required to provide with Form 941. According to the IRS, you can avoid incurring any IRS Form 941 penalties by doing all of the following:

- Deposit your quarterly tax payment when it's due.

- File Form 941 online or on paper, completely and on time.

- Accurately report your tax liability.

- Submit checks for tax payments that are valid.

- Furnish accurate W-2 Forms to your employees.

- File W-2 Forms (and Form W-3 if paper filing) with the SSA on time and accurately.

Penalties and interest are charged based on taxes paid late and returns filed late as a rate set by the IRS and federal law, but we'll get more into that later!

Visit https://www.taxbandits.com/form-94x-series/form-941-penalty/ for more information on Form 941 penalties.

Customer Support Options

Best of all, our dedicated support team is more than happy to assist you every step of the way! Please don't hesitate to contact us via phone, email, or live chat with any questions you may have.