File Form 1099-MISC for Reporting Miscellaneous Income

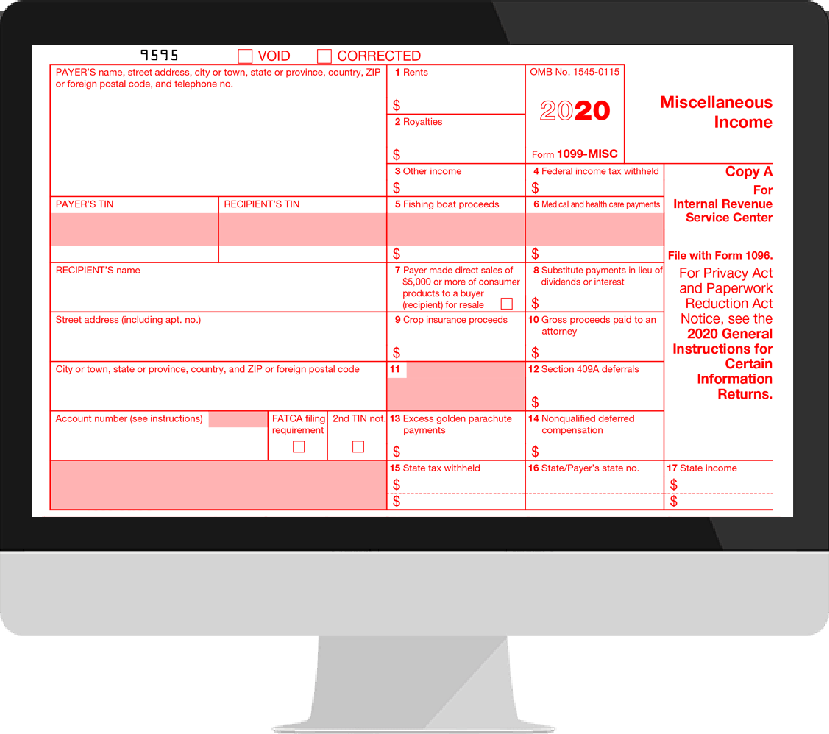

Form 1099-MISC - Miscellaneous Income

Form 1099-MISC is used to report miscellaneous income or payments made by businesses to people not considered to be its employees for various services performed. Examples of miscellaneous income include payments made to subcontractor wages, rental payments, prizes, awards, and more.

Non-employees that are compensated $600 or more for services rendered during the year must receive a Form 1099-MISC as well. However, recipients that work for multiple companies and earn a combined total of $600 will not receive a 1099-MISC but will still be required to report income tax.

Visit https://www.taxbandits.com/1099-forms/what-is-form-1099-misc/ to know more about the filing of the IRS 1099-MISC Form.

What is the difference between Form 1099-MISC and Form 1099-NEC?

The non-employee compensation is usually reported on Form 1099-MISC Box 7. The IRS relaunched 1099-NEC because of the confusion in the deadline to file 1099-MISC with nonemployee compensation. The arrival of this form means that the non-employee compensation doesn’t have to be filed using Form 1099-MISC anymore.

Filing Form 1099-MISC Electronically

Filing taxes for your business can be somewhat intimidating, but not with the simple filing process of TaxBandits! TaxBandits guides you with the information required to file and gives you step-by-step instructions to file correctly for the first time!

In order to file Form 1099-MISC correctly, the following four categories of information must be supplied:

- Payer Details (Name, EIN, and Address)

- Recipient Details (Name, EIN/Social Security, and Address)

- Federal Details (Miscellaneous Incomes and Federal Tax Withheld)

- State Filing Details (State Income, Payer State Number, and State Tax Withheld)

Form 1099-MISC must be filed with the IRS by January 31,2021 along with Copy B of the Form. However, businesses that e-file have a deadline of March 31, 2021.

Failing to file 1099-MISC by its deadline will result in expensive penalties from the IRS. If you correctly file within 30 days, the penalty is $30; $60 per return if you file more than 30 days late but by August 1, and $100 per return if you file after August 1 or you don't file at all. Returns must be complete and correct to avoid penalties.

Penalties for Not Filing Form 1099-MISC Correctly

Did you know that you could be penalized if you fail to file your 1099-MISC form correctly? Yes, in fact, there are a few errors that could cause you to incur charges from the IRS, such as

- 1) failing to file a correct information return by the due date and without reasonable cause,

- 2) filing by paper when required to file electronically

- 3) not reporting a Taxpayer Identification Number (TIN) or

- 4) reporting an incorrect TIN.

You can also be penalized for not providing correct statements to the payee (employee) for three reasons --

- 1) failing to provide a correct payee statement by the deadline and reasonable cause isn’t shown;

- 2) all required information isn’t provided; or

- 3) incorrect information is included on the statement.

Form 1099-MISC Corrections

Easily avoid these issues and penalties by filing with TaxBandits. Even if you make a mistake while filing and get rejected by the IRS, our service allows you to file a new form correcting the 1099 errors immediately.

Simply refile the form and use the provided indicators to make the necessary corrections through our comprehensive software.

TaxBandits is the Way to Go

TaxBandits provides small business owners and nonprofits with tax filing tools and features unique to the specific needs of these businesses and organizations. For more information on how to properly e-file Form 1099-MISC or correct a previously rejected return, visit our website or contact our 100%, US-based TaxBandits support team at 704.684.4571, Monday - Friday from 9AM to 6PM EST. We also offer live chat and 24/7 email support at [email protected].

Customer Support Options

Best of all, our dedicated support team is more than happy to assist you every step of the way! Please don't hesitate to contact us via phone, email, or live chat with any questions you may have.